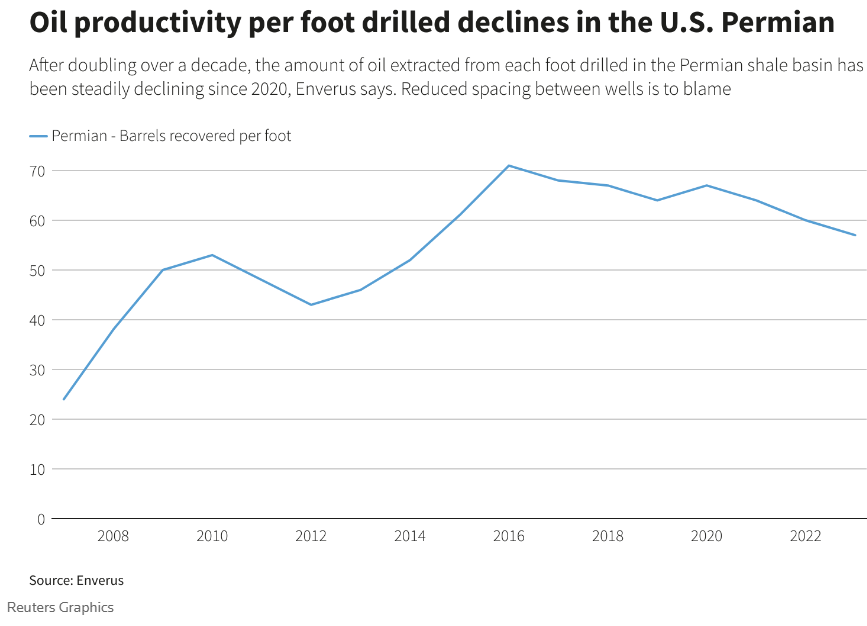

Recent technological advancements are significantly impacting the U.S. shale oil industry, reversing prior declines in well productivity despite the need for substantial upfront investments. From 2020 to 2023, productivity per foot drilled in the Permian Basin decreased by 15%, equating to levels seen a decade earlier, as reported by Enverus. This downturn was largely due to the inefficiencies in the fracking process, where dense well placements have adversely affected underground pressure.

However, innovations are now allowing for enhancements such as doubling the length of lateral wells to three miles and the introduction of electric pumps which are more cost-effective than traditional diesel pumps. These improvements are not only speeding up the fracking process but are also reducing its costs significantly. For instance, the implementation of simul-fracking, which enables simultaneous fracking of multiple wells, can reduce well costs by $200,000 to $400,000 each, translating to a 5%-10% cost reduction per well, according to Rystad Energy.

The adoption of these technologies is not without its challenges, primarily due to the high initial costs involved. Drilling multiple wells upfront, necessary for effective simul-fracking, can lead to around $100 million in preliminary expenses, posing a substantial financial challenge for smaller companies like Tall City Exploration. This is reflected in the 18% reduction in active drilling rigs across the U.S. compared to the previous year.

Despite these hurdles, the technological strides are poised to elevate U.S. oil production to unprecedented levels. The U.S. Energy Information Administration anticipates a 28% year-over-year increase in new-well production next month, marking the highest output in five months for major U.S. shale-producing areas. This surge is underpinned by increased efficiencies in fracking technology which are helping offset the decline in traditional productivity metrics.

Large oil corporations like Exxon Mobil and Chevron are strategically leveraging these technological advancements. Exxon plans to utilize its new fracking methods to boost its production from Pioneer’s assets by an additional 700,000 barrels of oil equivalent per day (boepd), aiming to triple its output to 2 million boepd by 2027. Meanwhile, Chevron is also optimizing its operations with simul-fracking and anticipates increasing its Permian production by 10% this year to 900,000 boepd. This includes scaling up their triple-frac pilot, hinting at broader applications going forward. Such strategic applications of innovative technologies illustrate a shift towards prioritizing efficiency and cost-effectiveness, setting a new standard for the industry’s future development.

In other news:

The U.S. upstream M&A (Mergers and Acquisitions) sector recorded $51 billion in announced deals during the first quarter of 2024, setting a pace that might surpass the previous year’s total of $192 billion. This significant activity highlights the dynamic changes and consolidation within the industry. Several major deals, including Exxon’s purchase of Pioneer and Chevron’s acquisition of Hess, are under heightened scrutiny by the Federal Trade Commission (FTC), reflecting increased anti-trust enforcement and concerns about the concentration of ownership in key U.S. unconventional plays. But companies are increasingly looking beyond the Permian to other areas like the Eagle Ford and SCOOP | STACK due to higher fragmentation and the potential for commodity diversification. The interest in these areas is also spurred by their capacity to supply Gulf Coast LNG projects, particularly as gas prices are expected to recover.