by Matthew Johnson

by Matthew Johnson

Recently, we reviewed some pressure pumpers and even took a stab at Eog Resources (EOG: $91), often called the Apple ($108.27) of U.S. shale. If Eog Resources is the Apple of U.S. Shale then is Pioneer (PXD: $224) the Uber-equivalent? Their CEO, Scott Sheffield, stated last week that their operating costs in the Permian Basin were close to $2 per BOE. Some have disputed this by looking deeper into their financials. Let’s take a look at what we’re good at which is frac jobs and frac spreads.

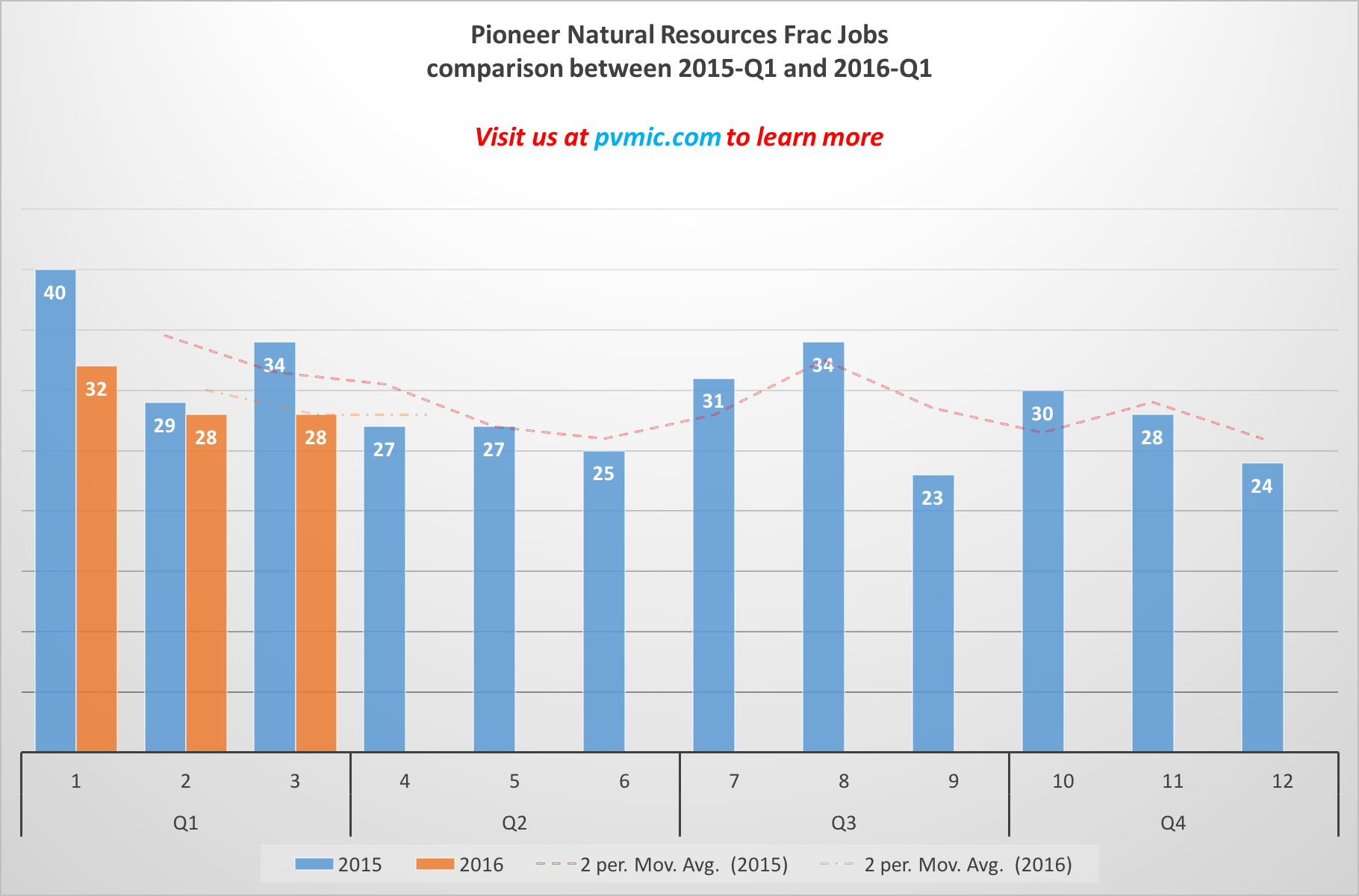

We’ve reported 440 frac jobs since the beginning of 2015 running through Q1 2016. PXD has shown a steady flow of work.

Pioneer is vertically integrated, so they do a lot of their own pressure pumping. However, we are tracking some activity with Halliburton (HAL: $43.84), Baker Hughes (BHI: $49.76) and Schlumberger (SLB: $81.20) in the last 18 months.

Here’s their top ten frac jobs by county since January of 2015:

The majority of their activity takes place in Midland (Permian), Upton (Permian) and Karnes (Eagle Ford) counties.

Pioneer has been a technological leader in many aspects of frac’ing including well selection, pressure pumping and refrac’ing. The inclusion of their own pressure pumping team gives them a logistical and financial advantage over 90% of E&Ps in the United States. Even if their CEO is exaggerating, it appears as their operational costs have shined a light on investors (their stock is up 40% since January of this year) and other shale companies that the impossible is, in fact, possible. If OPEC’s goal was to knock U.S. shale offline they may have won some battles, but companies like pxd are tenacious. The war is far from over.

sources:

Arthur Berman at oilprice.com “Pioneers $2 Operating Costs: Fact or Fiction?”

Rachel Aldrich at The Street “Pioneer Natural Resources Stock is the ‘Chart of the Day‘”

Nicholas Chapman at Market Realist “Analyzing Pioneer Natural Resources Q216 Earnings”